The 6-Minute Rule for Medicare Advantage Agent

Having medical insurance has numerous benefits. It secures you and your family from financial losses similarly that home or car insurance coverage does. Also if you remain in good health, you never recognize when you might have an accident or get ill. A journey to the medical facility can be far more pricey than you might anticipate.

Typical prices for giving birth depend on $8,800, and well over $10,000 for C-section delivery. 1,2 The total expense of a hip substitute can run a massive $32,000. These instances sound frightening, however the excellent news is that, with the best plan, you can safeguard on your own from a lot of these and other types of medical bills.

With a health insurance strategy, you aid protect the wellness and financial future of you and your family for a lifetime. Medicare Advantage Agent. With the new methods to obtain budget friendly medical insurance, it makes sense to get covered. Various other crucial benefits of health and wellness insurance are accessibility to a network of medical professionals and health centers, and various other resources to help you stay healthy

Medicare Advantage Agent - An Overview

Today, about 90 percent of U.S. locals have health and wellness insurance policy with substantial gains in health and wellness protection happening over the previous five years. Medical insurance helps with accessibility to care and is related to reduced death prices, much better health end results, and enhanced productivity. Regardless of recent gains, greater than 28 million individuals still lack insurance coverage, placing their physical, psychological, and economic health in danger.

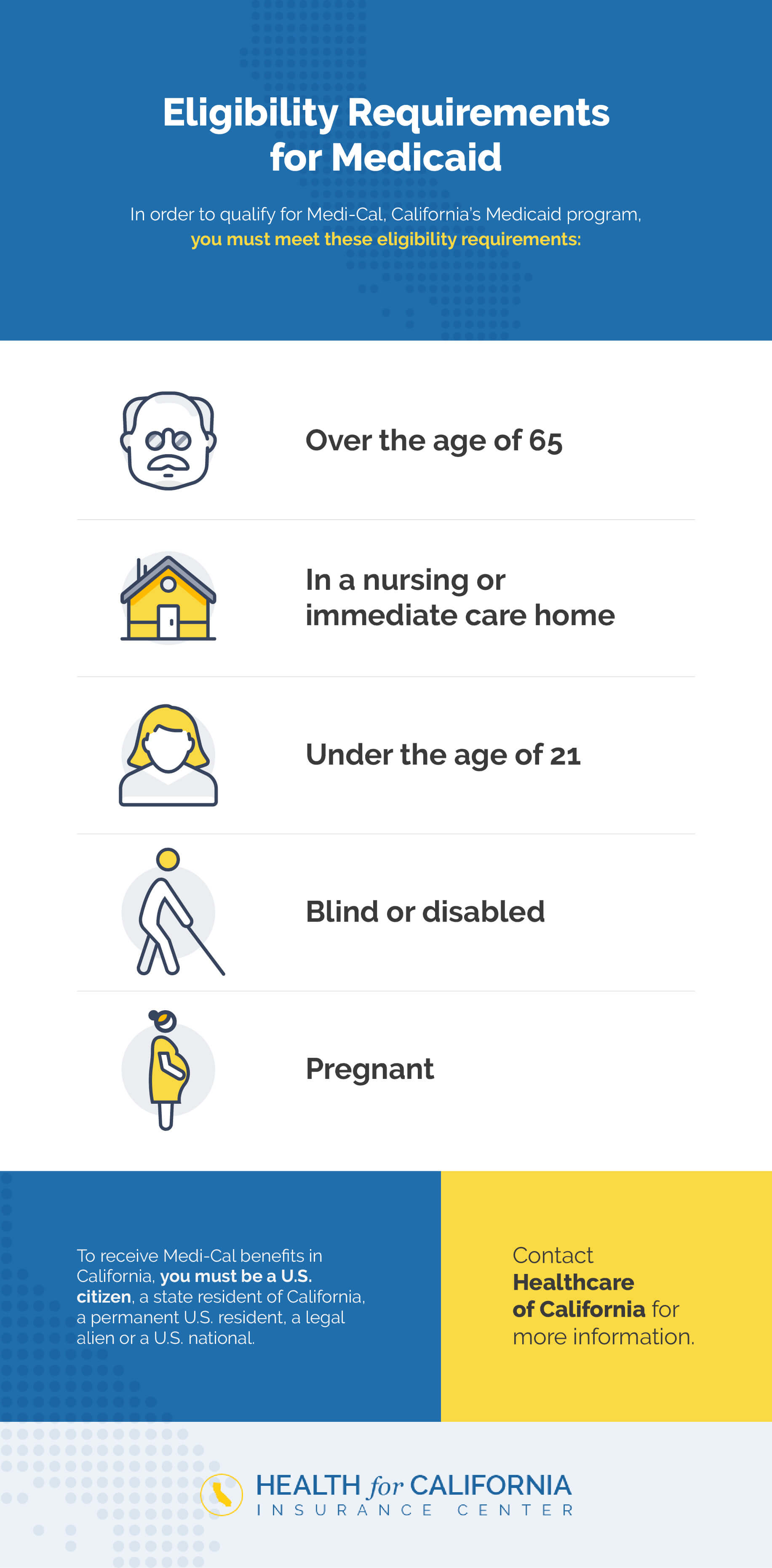

In certain, current studies that reviewed adjustments in states that increased Medicaid contrasted to those that really did not underscore the value of protection. Adult Medicaid enrollees are 5 times more likely to have routine sources of treatment and 4 times more probable to obtain preventative treatment solutions than people without insurance coverage.

An Unbiased View of Medicare Advantage Agent

People in Medicaid development states have higher rates of diabetic issues medical diagnoses than those in states that did not broaden. They receive extra prompt, and consequently much less complex, care for five typical surgical conditions. Medicaid development is connected with access to prompt cancer cells medical diagnoses and therapy.11,12,13,14,15 Coverage improvesgain access toto behavioral health and compound use disorder treatment. By 2016, 75 %of Medicaid enrollees with OUD filled prescriptions for medicine treatment. Coverage diminishes price barriers to accessing treatment. Less individuals in states that expanded Medicaid record cost as an obstacle to care than those in states that did not broaden Medicaid, and fewer people in development states report missing their medications as a result of cost. Hispanics have disproportionately high prices of being.

uninsured, without insurance compared to non-Hispanic whites. The high price of without insurance places stress on the wider health and wellness treatment system. Individuals without insurance policy placed off needed care and count a lot more heavily on health center emergency divisions, resulting in limited resources being directed to treat conditions that often can have been protected against or managed in a lower-cost setting. While all companies provide some level of charity treatment, it is inadequate to.

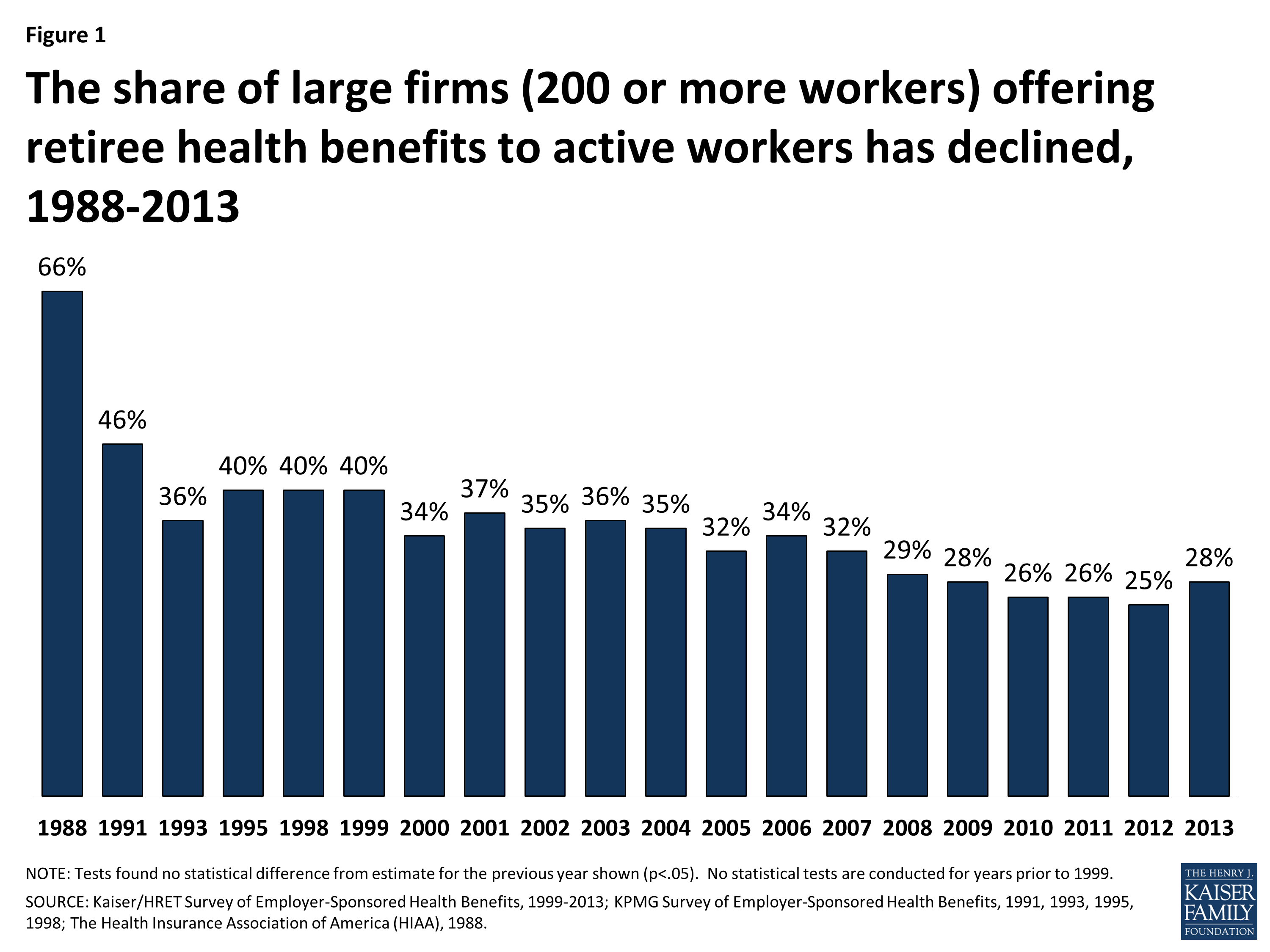

satisfy fully the demands of the uninsured (Medicare Advantage Agent). In 2017, healthcare facilities supplied$ 38.4 billion in uncompensated like clients. Nonetheless, health centers also took in an additional $76.8 billion in underpayments from Medicare and Medicaid, and are encountering extra financing decreases with cuts to the Medicare and Medicaid out of proportion share health center repayment programs. The Institute of Medicine(IOM )Board on the Repercussions of Uninsurance launches a prolonged examination of evidence that addresses the importance of health insurance protection with the publication of this record. Coverage Issues is the first in a collection of 6 records that will be released over the next two years recording the fact and repercussions of having actually an estimated 40 million people in the USA without health insurance policy protection. The Committee will look at whether, where, and just how the wellness and economic problems of having a large uninsured populace are really felt, taking a wide perspective and a multidisciplinary strategy to these inquiries. To a fantastic level, the costs and consequences of uninsured and unstably insured populaces are hidden and difficult to determine. The objective of this series of studies is to refocus plan attention on a longstanding problem.

Excitement About Medicare Advantage Agent

Following the lengthiest financial growth in American history, in 1999, an estimated one out of every six Americans32 million grownups under the age of 65 and more than 10 million childrenremains without insurance(Mills, 2000 ). This structure will certainly assist the analysis in succeeding records in the series and will certainly be customized to attend to each record's set of subjects.

The very first step in determining and measuring the repercussions of lacking health insurance coverage and of high uninsured prices at the community level is to recognize that the functions and constituencies offered by health and wellness insurance are numerous and distinct. 10 percent of the populace accounts for 70 percent of healthcare expenses, a connection that has actually stayed constant over the past 3 decades(Berk.

and Monheit, 2001). Therefore medical insurance continues to offer the feature of spreading danger also as it significantly finances routine care. From the viewpoint of health and wellness treatment companies, insurance why not find out more policy carried by their clients assists protect a revenue stream, and neighborhoods gain from financially feasible and secure healthcare professionals and organizations. Government offers health insurance to populaces whom the personal market might not offer successfully, such as impaired and elderly individuals, and populaces whose accessibility to wellness treatment is socially valued

, such as children and expecting ladies. The supreme ends of health and wellness insurance policy coverage for the specific and communities, consisting of work environment communities of employees and companies, are boosted health and wellness outcomes and lifestyle. Without doubt, the intricacy of American healthcare financing mechanisms and the wide range of resources of details include in the general public's confusion and suspicion regarding health and wellness insurance stats and their analysis. This record and thosethat will certainly adhere to purpose to boil down and offer in easily reasonable terms the comprehensive research study that births on concerns of health insurance protection and its value. Fifty-seven percent of Americans questioned in 1999 thought that those without medical insurance are"able to obtain the care they require from physicians and health centers" (Blendon et al., 1999, p. 207). In 1993, when national attention was concentrated on the issues of the without insurance and on pending health and wellnesscare regulation, simply 43 percent of those surveyed held this belief(Blendon et al., 1999 ). They additionally obtain less precautionary services and are much less most likely to have routine look after persistent problems such as high blood pressure and diabetes mellitus. Persistent conditions can cause expensive and disabling difficulties if they are not well handled(Lurie et al., 1984; Lurie et al., 1986; Ayanian et al., 2000 ). One additional reading nationwide survey asked greater than 3,400 grownups about 15 very serious or morbid conditions. Added evidence exists later on in this chapter in the conversation like this of insurance coverage and accessibility to health and wellness treatment. People without medical insurance are young and healthy and pick to go without insurance coverage. Practically half(43 percent )of those surveyed in 2000 thought that individuals without health insurance policy are a lot more likely to have health and wellness problems than individuals with insurance.